Subscribe to our Newsletter

Want to receive email alerts from CGIF? Kindly enter your name and e-mail address below to be the first to know of CGIF’s latest news, research, multimedia, career opportunities, and other updates.

Want to receive email alerts from CGIF? Kindly enter your name and e-mail address below to be the first to know of CGIF’s latest news, research, multimedia, career opportunities, and other updates.

CGIF’s bond guarantee operation is aimed at supporting ASEAN+3 companies access the Region’s bond markets to achieve the following benefits:

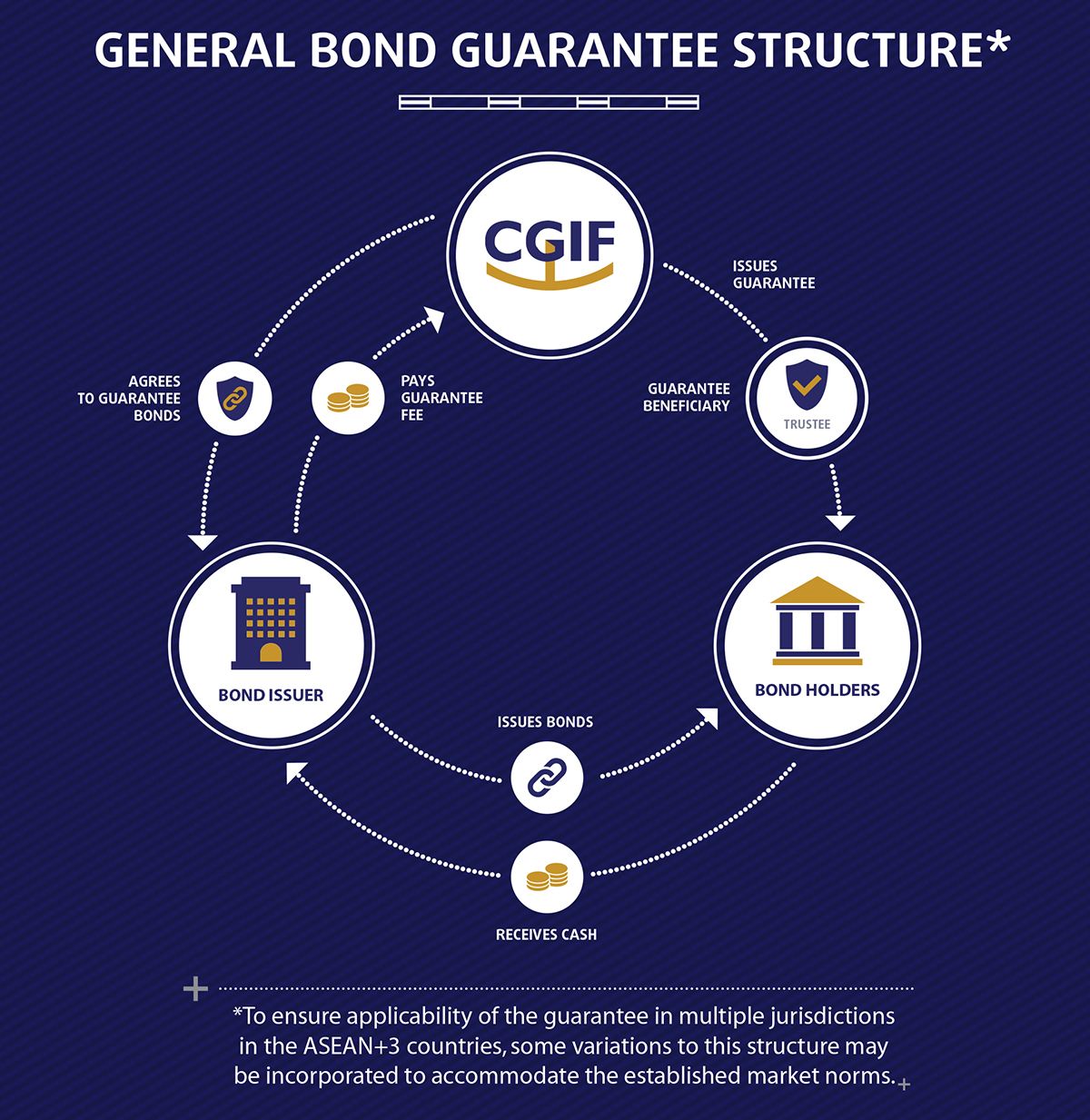

The guarantees issued by CGIF are irrevocable and unconditional commitments to pay bondholders upon non-payment by the issuers throughout the tenor of the bonds. This commitment is backed by CGIF’s equity capital which has been fully paid-in by all of its contributors. CGIF’s general bond guarantee structure is illustrated here.