Subscribe to our Newsletter

Want to receive email alerts from CGIF? Kindly enter your name and e-mail address below to be the first to know of CGIF’s latest news, research, multimedia, career opportunities, and other updates.

Want to receive email alerts from CGIF? Kindly enter your name and e-mail address below to be the first to know of CGIF’s latest news, research, multimedia, career opportunities, and other updates.

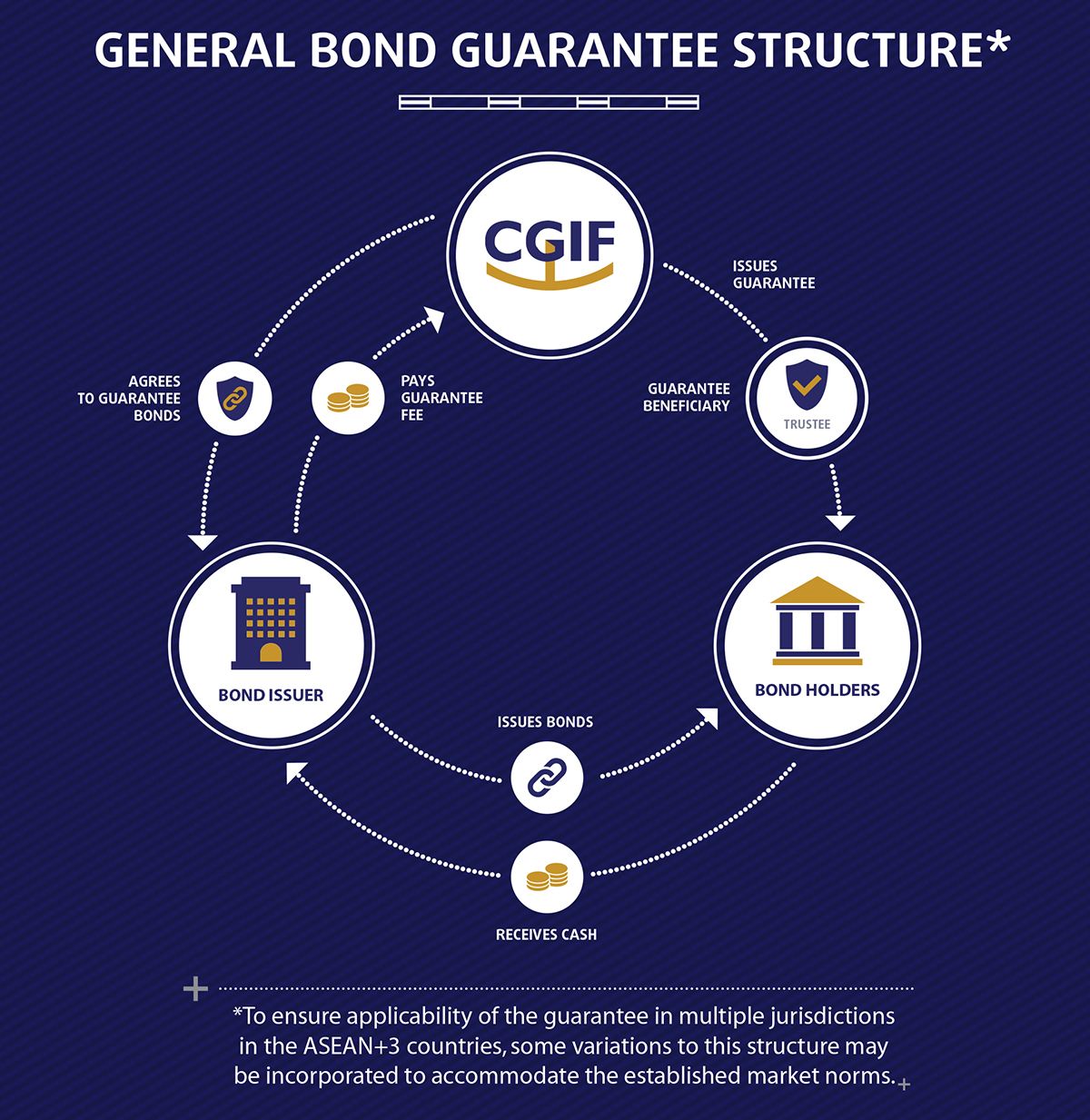

CGIF’s bond guarantee operations is aimed at supporting ASEAN+3 companies access the Region’s bond markets. The guarantees issued by CGIF are irrevocable and unconditional commitments to pay bondholders upon non-payment by the issuers throughout the tenor of the bonds. This commitment is backed by CGIF’s equity capital which has been fully paid-in by all of its contributors.

CGIF’s guarantees are available to ASEAN+3 corporate entities whose principal shareholders are from ASEAN+3 countries. However, entities whose principal shareholders are not from an ASEAN+3 country may be considered should proceeds be used for Eligible Developmental Purposes (“EDP”). In addition to meeting CGIF’s minimum acceptable credit profile, the entity’s project or business (for general funding purposes) should satisfy CGIF’s environmental and social safeguards standards and the proceeds of the CGIF guaranteed bond should not involve any activity in ADB’s prohibited investment activity list (PIAL).

CGIF’s approval process to guarantee a bond starts with a preliminary assessment where potential issuers must submit the Preliminary Information Pack for CGIF to assess eligibility. Following clearance from CGIF’s Guarantee Investment Committee to proceed, the potential issuer must submit a Formal Application Letter for the due diligence process to commence. After the guarantee underwriting proposal is approved by the Guarantee Investment Committee, it will be endorsed to the Board of Directors for their approval.

Eligible corporations based on the eligibility criteria are encouraged to submit base level information for a preliminary assessment either directly or via the respective bond arrangers. The information requirements for the preliminary assessment are summarized in the Preliminary Information Pack (PIP) form. The completed PIP form can be emailed to CGIF’s operations team at guarantee_enquiries@cgif-abmi.org with the contact details of the submitting party. Additional clarification or information may be required as part of the initial clearance process.